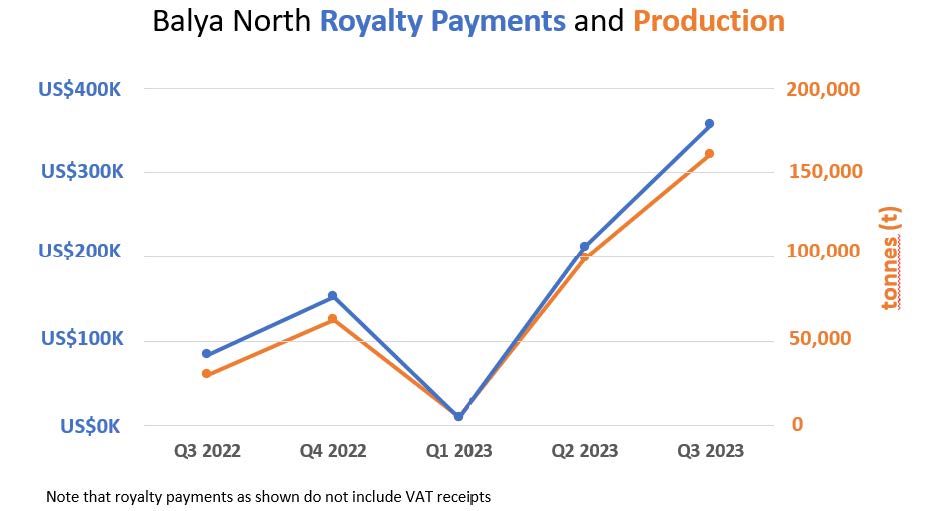

Vancouver, British Columbia, November 9, 2023 (NYSE American: EMX; TSX Venture: EMX; Frankfurt: 6E9) – EMX Royalty Corporation (the “Company” or “EMX”) is pleased to announce the receipt of US$356,718 in Q3 royalty proceeds from its Balya North royalty property in Türkiye, which is operated by Esan Eczacibaşi Endüstriyel Hammaddeler San. ve Tic. A.Ş. (“Esan”), a private Turkish company. EMX holds an uncapped 4% net smelter return (“NSR”) royalty on metals production from Balya North, a newly commissioned lead-zinc-silver mine in the Balya Mining District of northwestern Türkiye. The Q3 royalty payment is markedly higher than any previous payment and reflects another quarter of accelerating production at Balya North (see Figure 1).

The Q3 royalty payment was based upon the processing of 161,133 tonnes of mineralized material from Balya North, averaging 1.63% lead, 1.24% zinc and 51 grams per tonne of silver. Production continues to ramp up at Balya North after EMX received its initial royalty payments from the Balya North Mine in September 2022 (see EMX news release dated September 15, 2022).

Balya North Lead-Zinc-Silver Deposit: The Balya North lead-zinc-silver deposit is situated in the historic Balya mining district of northwestern Turkey. Mining at Balya has taken place since antiquity, with several generations of historical operations. The Balya North property contains extensive zones of shear-zone hosted and carbonate replacement style (“CRD”) lead-zinc-silver mineralization developed in and around a series of dacite intrusions emplaced into a limestone-rich sedimentary sequence.

Esan acquired the EMX royalty property at the end of 2019 (See EMX news release dated January 7, 2020) and is a private Turkish company that operates nearly 40 mines and eight processing plants. Esan also operates a lead-zinc mine (“Balya Main”) and flotation mill on the property immediately adjacent to EMX’s Balya North royalty property. The mineralization at Balya North is effectively an extension of the mineralization currently being mined by Esan in the Balya Main deposit.

Dr. Eric P. Jensen, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and the TSX Venture Exchange under the symbol EMX, and also trade on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

|

David M. Cole |

Scott Close |

Isabel Belger |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward-looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserve and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended June 30, 2023 (the “MD&A”), and the most recently filed Revised Annual Information Form (the “AIF”) for the year ended December 31, 2022, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedarplus.ca and on the SEC’s EDGAR website at www.sec.gov.

Figure 1: Royalty payments and production from Balya North Mine by quarter