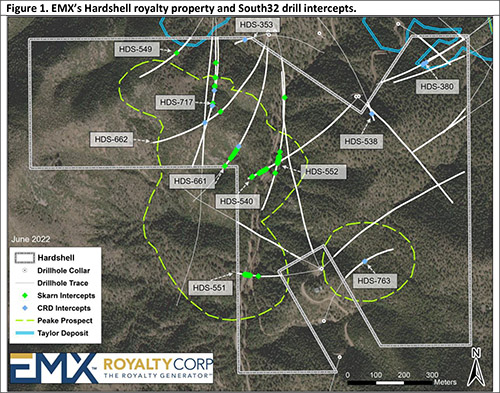

Vancouver, British Columbia, June 21, 2022 (NYSE American: EMX; TSX Venture: EMX; Frankfurt: 6E9) – EMX Royalty Corporation (the “Company” or “EMX”) is pleased to announce drill results from EMX’s Hardshell royalty property at a new exploration target, named the Peake prospect, which is part of South32 Limited’s Hermosa project in southeast Arizona (Figure 1). Hermosa also includes the feasibility stage Taylor lead-zinc-silver deposit situated directly north of EMX’s royalty claim block (see map in Appendix 1). EMX retains a 2% net smelter return (“NSR”) royalty on Hardshell that is not capped nor subject to buy down.

Drill results from Peake, which is partially covered by the Hardshell royalty, include copper-enriched skarn type mineralized intercepts of 76.5 meters (1,308.2-1,384.7 m) averaging 1.52% copper, 0.2% zinc, 0.4% lead, and 25 g/t silver in hole HDS-552, as well as 73.8 meters (1,386.8-1,460.6 m) averaging 1.06% copper, 0.5% zinc, 0.7% lead, and 67 g/t silver in HDS-661. In addition, intercepts more typical of Taylor carbonate replacement deposit (“CRD”) style mineralization include 9.8 meters (966.2-976.0 m) averaging 0.69% copper, 12.2% zinc, 8.2% lead, and 77 g/t silver in HDS-353. South32’s geological model indicates the potential for Peake to host a structurally and lithologically controlled mineralized skarn system that connects to the Taylor CRD mineralization.

EMX’s Hardshell royalty was organically generated by the Company’s wholly-owned subsidiary Bronco Creek Exploration Inc. (“BCE”). BCE recognized the alteration and mineralization zoning patterns within the district, and staked prospective open ground. Hardshell was optioned in 2015 for a 2% NSR retained royalty interest. The Hermosa project, including Hardshell, was subsequently acquired by South32 in 2018. South32 has steadily advanced Hermosa, which now includes the step-out exploration drilling that has delineated Peake. The Peake mineralization covered by the Hardshell royalty highlights the discovery optionality within EMX’s royalty portfolio.

Discussion of Drill Results. South32’s drilling at Hardshell has focused on the copper-rich skarn mineralization at the Peake prospect, but has also intersected potential extensions of the Taylor CRD system. Peake consists of copper-lead-zinc-silver mineralization delineated as a 1,200 meter by 550 meter, west-northwest trending zone of variable thickness at depths of 1,300 to 1,500 meters. South32 is following up on the Peake drill results as part of its Hermosa exploration programs, and has directed US$13 million to its exploration programs at Hermosa in the nine months ended March 2022.1

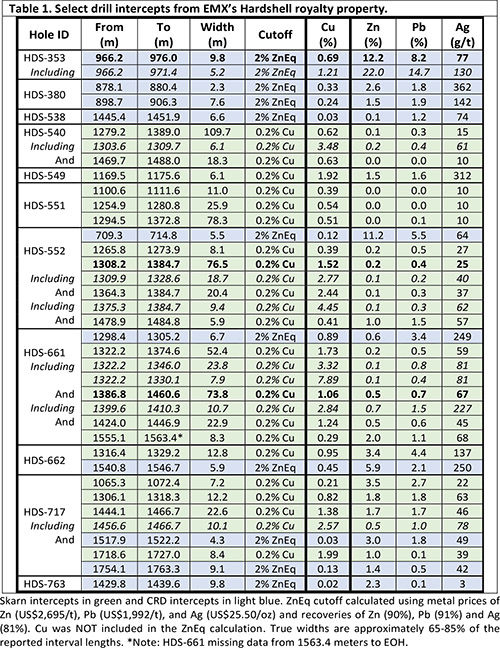

EMX’s royalty covers much of the currently known extents of the Peake prospect, and South32 has provided EMX a database with ~23,300 meters of angled diamond drilling from within the Hardshell royalty footprint. Select intercepts are summarized in Table 1. Copper-enriched skarn intercepts are reported at a 0.2% copper cutoff, reflecting the early-stage nature of exploration and evaluation of the Peake prospect. CRD style intercepts are reported at a 2.0% zinc equivalent (“ZnEq”) cutoff, reflecting the current feasibility stage of evaluation for the Taylor deposit.

Skarn intercepts in green and CRD intercepts in light blue. ZnEq cutoff calculated using metal prices of Zn (US$2,695/t), Pb (US$1,992/t), and Ag (US$25.50/oz) and recoveries of Zn (90%), Pb (91%) and Ag (81%). Cu was NOT included in the ZnEq calculation. True widths are approximately 65-85% of the reported interval lengths. *Note: HDS-661 missing data from 1563.4 meters to EOH.

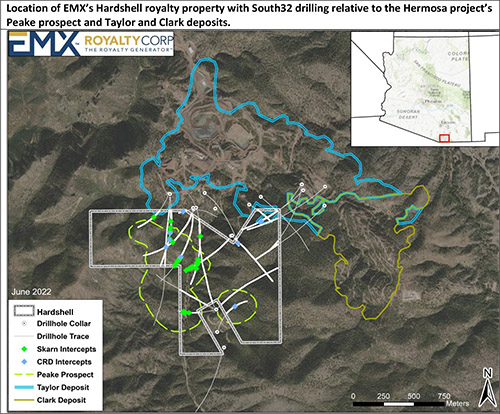

Hermosa Project and Hardshell Royalty Property Overview. South32’s Hermosa project, located in the Patagonia mining district of southeastern Arizona, includes CRD sulfide (i.e., Taylor) and oxide (i.e., Clark) deposits (which are not covered by EMX’s Hardshell royalty), as well as the Peake skarn prospect (partially covered by EMX’s Hardshell royalty). In a July 21, 2021 Public Report titled “Hermosa Project – Mineral Resource Estimate Update” South32 disclosed a JORC (2012) Mineral Resource estimate for Taylor at a US$80/dmt NSR cutoff as a) 29 Mtonnes @ 4.10% Zn, 4.05% Pb, and 57 g/t Ag Measured, b) 86 Mtonnes @ 3.76% Zn, 4.44% Pb, and 86 g/t Ag Indicated, c) and 24 Mtonnes @ 3.73% Zn, 3.82% Pb, and 91 g/t Ag Inferred.2 The resource estimate was prepared by M. Hastings, MAusIMM, of SRK Consulting (US), a Competent Person in accordance with the requirements of the JORC Code. JORC is an “acceptable foreign code” under NI 43-101 for disclosure of mineral resources and mineral reserves.

In a January 17, 2022 Public Report, South32 announced an update to the Hermosa project with the completion of a pre-feasibility study on the Taylor deposit and a scoping study for the Clark deposit.3 South32 also stated that 1) Taylor had moved to the feasibility stage of evaluation with a final investment decision expected by mid-2023, and 2) shaft development is expected to commence in FY2024, subject to a final investment decision and receipt of required permits.

EMX’s Hardshell 2% NSR royalty property consists of 16 unpatented federal lode mining claims that are included as part of South32’s Hermosa project. Mineralization is primarily hosted within a sequence of dipping upper Paleozoic (i.e., Pennsylvanian-Permian) carbonate sedimentary rocks adjacent to the Sunnyside porphyry system which is being explored by Barksdale Resources (TSX-V: BRO). The delineation of the Peake prospect by South32 represents the potential to create significant value for the Company’s Hardshell royalty property. EMX looks forward to South32’s continued exploration success at Hardshell, as well as from the greater Hermosa project.

Comments on Adjacent Properties. The adjacent properties, which include South32’s Taylor deposit and Barksdale’s Sunnyside Project, provide geological context for the Peake prospect, which is partially covered by EMX’s Hardshell royalty claim block. However, this is not necessarily indicative that the Hardshell royalty claim block represents similar tonnages or grades of mineralization as at the Taylor deposit, nor a similar style of mineralization as the Sunnyside porphyry.

Qualified Person. Michael P. Sheehan, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”, and also trade on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

1 South32 Quarterly Report March 2022.

2 South32 market release dated July 21, 2021 (titled “Hermosa Project - Mineral Resource Estimate Update”) and Annual Report 2021 dated September 21, 2021.

3 South32 market release dated January 17, 2022 (titled “Hermosa Project Update”).

For further information contact:

| David M. Cole President and CEO Phone: (303) 973-8585 Dave@EMXroyalty.com |

Scott Close Director of Investor Relations Phone: (303) 973-8585 SClose@EMXroyalty.com |

Isabel Belger Investor Relations (Europe) Phone: +49 178 4909039 IBelger@EMXroyalty.com |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended March 31, 2022 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2021, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

Appendix 1