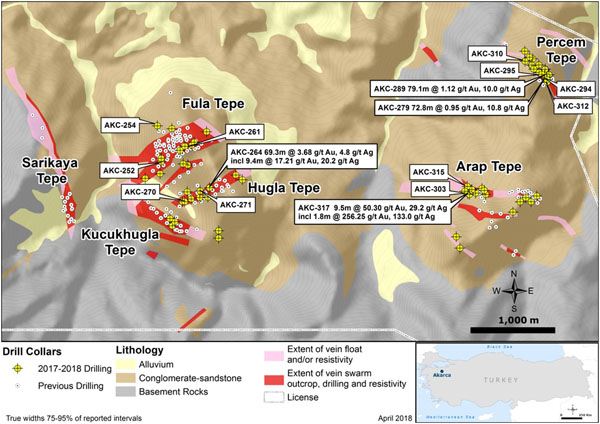

Vancouver, British Columbia, April 17, 2018 (TSX Venture: EMX; NYSE American: EMX) – EMX Royalty Corp. (the “Company” or “EMX”) is pleased to announce the receipt of drill data for the 2017 and ongoing exploration programs at the Akarca royalty property in western Turkey (the “Property”). Çiftay İnşaat Taahhüt ve Ticaret A.Ş. (“Çiftay”), the owner and operator of the Akarca project, has informed EMX that it completed 7,844 meters of diamond drilling across five target areas, resulting in a significant increase in the footprints of drill defined gold and silver mineralization on the Property. Çiftay reported multiple high grade intercepts, including 9.5 meters averaging 50.30 g/t gold and 29.2 g/t silver with a sub-interval of 1.8 meters averaging 256.25 g/t gold and 133.0 g/t silver in hole AKC-317 (true width ~85-95%), drilled in the Arap Tepe “Zone C” area, as well as 69.3 meters averaging 3.68 g/t gold and 4.8 g/t silver in hole AKC-264 (true width ~75-85%), drilled in the Hugla Tepe area (see Figure 1 for drilling location map). The program also included 24 new holes in the Percem Tepe target area, 23 of which contained significant intercepts of gold mineralization (see Table 1 for select drill intercepts).

Çiftay continues to advance the Akarca project toward the deposit delineation and development stage, with ongoing drilling and trenching, as well as additional metallurgical studies, planned for 2018.

EMX also received a cash payment of US $665,525 in February 2018, the cash equivalent of 500 ounces of gold. The payment was the third in a schedule of pre-production bullion-based payments to be made to EMX as part of the acquisition terms for the project. Thus far, EMX has received the cash equivalent of 1,500 ounces of gold, with 5,500 ounces of gold (or the cash equivalent) remaining to be paid. EMX also retains a scaled royalty interest on the project, in addition to other consideration. See EMX news release dated August 8, 2016 and www.EMXRoyalty.com for additional information.

Exploration Update. Work completed on the Akarca Project, as recently reported by Çiftay to EMX, includes 7,844 meters of diamond drilling and 4,244 meters of exploration trenches. As shown in Figure 1, the drilling included infill campaigns at the Fula Tepe, Hugla Tepe, Kucukhugla Tepe and Arap Tepe “Zone A” project areas, as well as new drill programs at the Arap Tepe “Zone C” and the Percem Tepe targets. In particular, the new work at Percem Tepe greatly expanded the drill defined footprint of mineralization in that area, including intercepts of 79.1 meters averaging 1.12 g/t gold and 10.0 g/t silver in drill hole AKC-289 (true width ~80-85%), and 72.8 meters averaging 0.95 g/t gold and 10.8 g/t silver in hole AKC-279 (true width ~90%), with mineralization commencing from the surface in both holes.

While the Fula Tepe, Hugla Tepe, Kucukhugla Tepe and Arap Tepe “Zone A” project areas have seen considerable previous work, the drilling at Arap Tepe “Zone C” and Percem Tepe represents new areas of focus. Since acquiring the project in August 2016, Çiftay has continued to test new areas and develop new target concepts throughout the Property.

Çiftay has informed EMX that it intends to greatly expand the areas permitted for drilling, and will initiate a 25,000 meter drill program across multiple target areas during the year. Çiftay is also planning to conduct more advanced metallurgical studies on the Property in 2018.

Project Overview. Akarca is a low sulfidation, epithermal gold-silver district located in the Western Anatolia mineral belt that was discovered by EMX in 2006. Exploration programs at Akarca, principally funded by partners, have included 374 core and reverse circulation holes totaling over 40,000 meters of drilling, environmental studies, geologic mapping, geochemical sampling, and geophysical surveys.

Akarca is an excellent example of EMX’s execution of the royalty generation aspect of its business model. After EMX’s discovery and early exploration, partner funded work delineated multiple zones of near-surface gold and silver mineralization on the Property. This led to the agreement with Çiftay, a leading Turkish construction and mining company that conducts mining operations at the Çöpler gold mine in Turkey. Çiftay operates as a private company in Turkey.

Drilling, Sampling, Assaying, and QA/QC. Çiftay’s exploration samples are collected in accordance with industry best practice standards and guidelines. These procedures and protocols were originally established by EMX for the Akarca project. The samples were submitted to ALS laboratories in Izmir, Turkey (ISO 9001:2000) and Vancouver, Canada (ISO 9001:2000 and 17025:2005 accredited) for sample preparation and analysis. Gold was analyzed by fire assay with an AAS finish, and silver underwent aqua regia digestion and analysis with MS/AES techniques. Over limit assays for gold (> 10 g/t Au) were conducted with fire assay and a gravimetric finish, and over limit analyses for silver (> 100 g/t Ag) were performed with aqua regia digestion and ICP/AES techniques. As standard procedure, Çiftay carries out routine QA/QC analysis on all assay results, including the systematic utilization of certified reference materials, blanks, and duplicate samples.

Other News - Receipt of Audit Opinion with Going Concern Qualification. As previously disclosed in its Annual Report on Form 20-F for the fiscal year ended December 31, 2017, which was filed on April 3, 2018 with the United States Securities and Exchange Commission on EDGAR, as well as with the Canadian securities regulatory authorities on SEDAR, the Company’s audited financial statements contained a going concern explanatory paragraph in the audit opinion from its independent registered public accounting firm. The foregoing, which is required disclosure according to NYSE American guidelines, does not represent any change or amendment to the Company’s financial statements or to its Annual Report on Form 20-F for the fiscal year ended December 31, 2017.

Dr. Eric P. Jensen, CPG, is a Qualified Person under NI 43-101 and employee of the Company. Dr. Jensen has reviewed, verified and approved disclosure of the technical information contained in this news release.

About EMX. EMX leverages asset ownership and exploration insight into partnerships that advance our mineral properties, with EMX retaining royalty interests. EMX complements its generative business with strategic investment and third party royalty acquisition.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 979-6666

Email: Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

Email: SClose@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metals, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause EMX’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the 12 month period that ended December 31, 2017 (the “MD&A”), and themost recently filed Form 20-F for the year ended December 31, 2017, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the 20-F and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

Figure 1. Akarca drill hole location map (April, 2018).

|

Table 1. Akarca select drill intercepts (April, 2018). |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||