Vancouver, British Columbia, December 18, 2017 (TSX Venture: EMX; NYSE American: EMX) – EMX Royalty Corporation (the “Company” or “EMX”) is pleased to announce the execution of an option agreement (the “Agreement”), through its wholly owned subsidiary Bronco Creek Exploration Inc. (“BCE”), for the Greenwood Peak copper porphyry project (the “Project”) with a wholly owned subsidiary of Antofagasta plc (“Antofagasta”). The Agreement provides for work commitments as well as cash payments to EMX during Antofagasta’s earn-in period, and upon earn-in, a 2% NSR royalty interest in addition to milestone and pre-production payments to EMX’s benefit. The Project, located approximately 175 kilometers northwest of Phoenix, Arizona, contains a copper porphyry target concealed beneath younger gravels and basin fill sediments. Please see attached maps and www.emxroyalty.com for more information.

Commercial Terms Overview. Pursuant to the Agreement, Antofagasta can earn 100% interest in the Greenwood Peak Project by (all dollar amounts in USD):

- Reimbursing BCE’s acquisition costs and making annual option payments, together totaling $630,000, and

- Completing $4,500,000 in work expenditures within the five year option period. BCE will be the operator of the Project for Antofagasta.

Upon exercise of the option EMX will retain a 2% NSR royalty on the Project, which is not capped and not subject to buy-down.

After exercise of the option, annual advance royalty (“AAR”) payments are due starting at $100,000 on the first anniversary of the exercise of the option, and will increase to $175,000 upon completion of a scoping study for the Project. Antofagasta may make a one-time payment of $4,000,000 to extinguish the obligation to make AAR payments after completion of the scoping study. All AAR payments are recoupable against royalty payments owed to EMX.

Antofagasta will also make Project milestone payments consisting of:

- $500,000 upon completion of a scoping study,

- $1,000,000 upon completion of a pre-feasibility study, and

- $2,000,000 upon completion of a feasibility study. The feasibility milestone payment is recoupable against royalty payments owed to EMX.

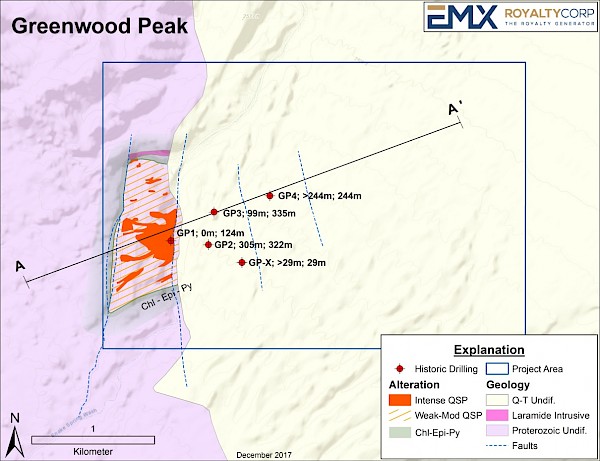

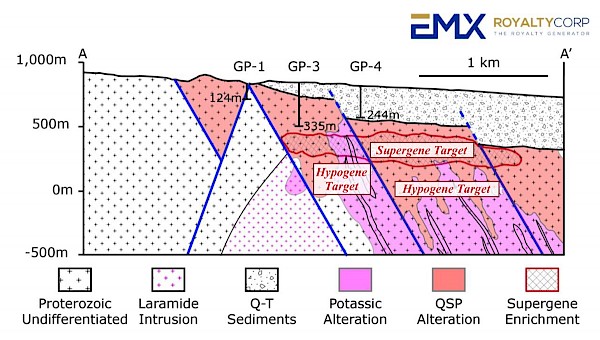

Project Overview. The Greenwood Peak Project totals 117 federal lode mining claims covering more than 970 hectares, and is located ~25 kilometers southwest of the Bagdad copper mine. EMX originally identified the Project’s prospectivity by the recognition of copper porphyry-style quartz-sericite-pyrite veining and alteration in outcrops adjacent to the covered target area. These outcrops are interpreted as the western, distal edge of a porphyry system that has been down-dropped eastward and covered by onlapping post-mineral sediments. EMX and Antofagasta are targeting supergene and hypogene copper mineralization related to a porphyry system interpreted to be concealed beneath unconsolidated sediments and shallow cover rocks.

ASARCO explored the area in the 1960s and conducted induced polarization (“IP”) geophysical surveys in addition to reconnaissance drilling on the property. Two vertical holes were completed within the current target area that intersected altered host rocks. The first drill hole (GP3) intersected highly weathered, oxidized, and leached quartz-sericite altered rocks beneath young gravels at 99 meters, and terminated in these rocks at 335 meters. The second hole (GP2), located approximately 300 meters south-southwest of GP3, intersected propylitically altered host rocks below gravels at 305 meters and was terminated at 322 meters.

The initial Greenwood Peak drill program will test supergene and hypogene copper porphyry targets to the north and east of historic drill hole GP3. The Project is drill ready and fully permitted. Antofagasta approved a three hole reconnaissance program that recently commenced.

The Greenwood Peak Agreement is another example of EMX’s successful execution of the organic royalty generation aspect of the Company’s business model. EMX acquired Greenwood Peak in 2016 by staking prospective open ground in a productive Arizona copper porphyry belt, and the Project is now being advanced with Antofagasta, a top tier partner. Antofagasta is an EMX shareholder dating back from a previous regional strategic alliance, and the Company is enthusiastic to work with Antofagasta again. EMX now has four Arizona copper porphyry projects advancing with major mining companies for cash payments and retained EMX royalty interests.

Michael P. Sheehan, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX leverages asset ownership and exploration insight into partnerships that advance our mineral properties, with EMX receiving pre-production payments and retaining royalty interests. EMX complements its royalty generation initiatives with royalty acquisitions and strategic investments.

-30-

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 979-6666

Email: Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

Email: SClose@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merits of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the nine month period that ended on September 30, 2017 (the “MD&A”), and the most recently filed Form 20-F for the year that ended on December 31, 2016, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the 20-F and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.