Parks-Salyer, Arizona

Location

Arizona, USA

Operator

Arizona Sonoran Copper Company

Commodity

Copper-Molybdenum

Royalty

0.5% NSR & other payments

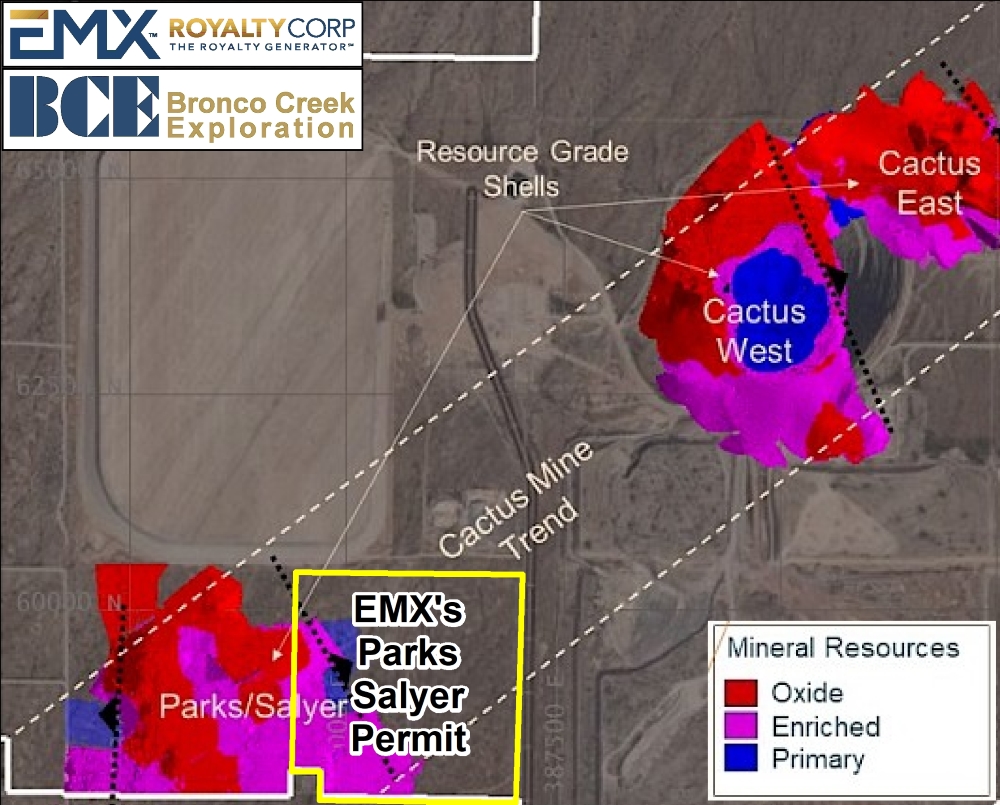

Parks-Salyer is located ~5km northwest of Casa Grande, Arizona. Parks-Salyer is a porphyry copper and enriched oxide copper system 1.5km SW of the historical Sacaton open pit copper Mine. EMX geologists recognized the potential for the expansion of the historic copper occurrence at Parks-Salyer and inexpensively acquired available mineral rights over the eastern portion of the deposit.

In 2022, EMX executed an agreement with Arizona Sonoran Copper Company, Inc. (“ASCU”) for the rights to EMX’s Arizona State Exploration Permit (See EMX News Release dated February 10, 2022). Under this agreement, EMX originally retained a 1.5% NSR royalty on the permit, 1% of which ACSU bought back with a payment of $500,000 in January 2025. EMX currently retains a 0.5% royalty on the permit. Parks-Salyer is controlled and operated by ASCU as part of their Cactus project.

In Q3 2024, ASCU announced an updated mineral resource for the Cactus Project1 in a NI 43-101 Preliminary Economic Assessment (PEA), which rescopes Parks-Salyer as an open pit operation. The PEA also extends the estimated mine life by a decade, to 31 years.

|

Category |

Material Type |

Tons (kt) |

Grade |

Contained Metal |

||

|

CuT% |

Tsol% |

Cu (klbs) |

Tsol (klbs) |

|||

|

OPEN PIT |

MEASURED |

|||||

|

Oxide |

4,000 |

0.476 |

0.456 |

38,100 |

36,500 |

|

|

Enriched |

41,100 |

1.150 |

0.966 |

943,000 |

792,100 |

|

|

Primary |

10,900 |

0.528 |

0.056 |

115,100 |

12,200 |

|

|

Total Measured |

55,900 |

0.981 |

0.752 |

1,096,200 |

840,800 |

|

|

INDICATED |

||||||

|

Oxide |

34,400 |

0.469 |

0.469 |

322,700 |

300,700 |

|

|

Enriched |

166,900 |

0.810 |

0.810 |

2,703,800 |

2,370,000 |

|

|

Primary |

80,400 |

0.423 |

0.423 |

680,200 |

69,100 |

|

|

Total Indicated |

281,700 |

0.658 |

0.658 |

3,706,700 |

2,739,800 |

|

|

MEASURED + INDICATED |

||||||

|

Oxide |

38,400 |

0.470 |

0.439 |

360,800 |

337,100 |

|

|

Enriched |

207,900 |

0.877 |

0.760 |

3,646,800 |

3,162,100 |

|

|

Primary |

91,400 |

0.435 |

0.045 |

795,300 |

81,400 |

|

|

Total M+I |

337,700 |

0.711 |

0.530 |

4,802,900 |

3,580,600 |

|

|

INFERRED |

||||||

|

Oxide |

43,100 |

0.372 |

0.328 |

320,400 |

282,900 |

|

|

Enriched |

191,300 |

0.436 |

0.388 |

1,669,200 |

1,484,100 |

|

|

Primary |

54,100 |

0.395 |

0.038 |

427,100 |

41,000 |

|

|

Total Inferred |

288,500 |

0.419 |

0.313 |

2,416,700 |

1,808,000 |

|

|

UNDERGROUND |

MEASURED |

|||||

|

Oxide |

- |

- |

- |

- |

- |

|

|

Enriched |

5 |

1.299 |

0.924 |

134 |

95 |

|

|

Primary |

43 |

0.770 |

0.071 |

669 |

92 |

|

|

Total Measured |

49 |

0.826 |

0.161 |

909 |

157 |

|

|

INDICATED |

||||||

|

Oxide |

9 |

0.660 |

0.642 |

125 |

122 |

|

|

Enriched |

1,104 |

0.962 |

0.850 |

21,200 |

18,800 |

|

|

Primary |

76 |

0.767 |

0.115 |

1,200 |

200 |

|

|

Total Indicated |

1,200 |

0.938 |

0.796 |

22,500 |

19,100 |

|

|

MEASURED + INDICATED |

||||||

|

Oxide |

9 |

0.660 |

0.642 |

125 |

122 |

|

|

Enriched |

1,100 |

0.972 |

0.858 |

21,300 |

18,900 |

|

|

Primary |

100 |

0.916 |

0.118 |

1,900 |

262 |

|

|

Total M+I |

1,200 |

0.971 |

0.804 |

23,300 |

19,300 |

|

|

INFERRED |

||||||

|

Oxide |

4,001 |

0.801 |

0.737 |

64,100 |

59,000 |

|

|

Enriched |

5,600 |

0.863 |

0.776 |

97,100 |

87,300 |

|

|

Primary |

1,000 |

0.815 |

0.258 |

16,700 |

5,300 |

|

|

Total Inferred |

10,600 |

0.839 |

0.715 |

177,900 |

151,600 |

|

* Denotes Cu Tsol generated using sequential assaying to calculate the grade soluble Cu

Notes:

- The Qualified Person for the mineral resource statement is Allan L. Schappert, CPG, SME-RM, ALS Geo Resources LLC.

- Total soluble copper grades (Cu TSol) are reported using sequential assaying to calculate the soluble copper grade. Tons are reported as short tons.

- Parks/Salyer-MainSpring mineral resource estimates have an effective date of 11th July, 2024. All mineral resources use a copper price of US$3.75/lb.

- Technical and economic parameters defining mineral resource pit shells: mining cost US$2.43/t; G&A US$0.55/t, 10% dilution, and 44°-46° pit slope angle.

- Technical and economic parameters defining underground mineral resource: mining cost US$27.62/t, G&A US$0.55/t, and 5% dilution. Underground mineral resources are only reported for material located outside of the open pit mineral resource shells. Designation as open pit or underground mineral resources are not confirmatory of the mining method that may be employed at the mine design stage.

- Technical and economic parameters defining processing: Oxide heap leach (“HL”) processing cost of US$2.24/t assuming 86.3% recoveries, enriched HL processing cost of US$2.13/t assuming 90.5% recoveries, sulfide mill processing cost of US$8.50/t assuming 92% recoveries. HL selling cost of US$0.27/lb; Mill selling cost of US$0.62/lb.

- Variable cut-off grades were reported depending on material type, potential mining method, potential processing method, and applicable royalties. For ASCU properties - Oxide open pit or underground material = 0.099% or 0.549% TSol respectively; enriched open pit or underground material = 0.092% or 0.522% TSol respectively; primary open pit or underground material = 0.226% or 0.691% CuT respectively. For state land property – Oxide openpit or underground material = 0.098 % or 0.545% TSol respectively; enriched open pit or underground material = 0.092% or 0.518% TSol respectively; primary open pit or underground material = 0.225% or 0.686% CuT respectively. For MainSpring properties – Oxide open pit or underground material = 0.096% or 0.532% TSol respectively; enriched open pit or underground material = 0.089% or 0.505% TSol respectively; primary open pit or underground material = 0.219% or 0.669% CuT respectively. Stockpile cutoff = 0.095% TSol.

- Mineral resources, which are not mineral reserves, do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, sociopolitical, marketing, or other relevant factors.

- The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there is insufficient exploration to define these inferred mineral resources as an indicated or measured mineral resource; it is uncertain if further exploration will result in upgrading them to an indicated or measured classification.

- Totals may not add up due to rounding

*EMX, as a royalty holder, does not have access to the data necessary to report the portion of the mineral resources and mineral reserves covered by its Parks-Salyer royalty property. However, in Q4 2022 EMX received a $3,000,000 milestone payment from ASCU based upon declared mineral resources totaling more than 200 million pounds of contained copper covered by the Parks-Salyer royalty. Specifically, ASCU reported to EMX that a total of 725.5 million pounds of contained copper (approximately 25% of the total contained copper from the 2022 total inferred mineral resource of 2,915 Mlbs contained copper) were covered by the EMX royalty. The Company notes that the footprint of the Parks-Salyer deposit within EMX’s royalty property boundary has not changed materially from the 2022 to the 2024 resource models.

**Nearby mines and deposits provide context for the project, but do not necessarily indicate similar size, styles or grade of mineralization within the project.

1 https://arizonasonoran.com/news-releases/arizona-sonoran-cactus-project-standalone-pea-technical-report-reporting-post-tax-npv8-of-us-2.03-billion-and-irr-of-24-is-now/

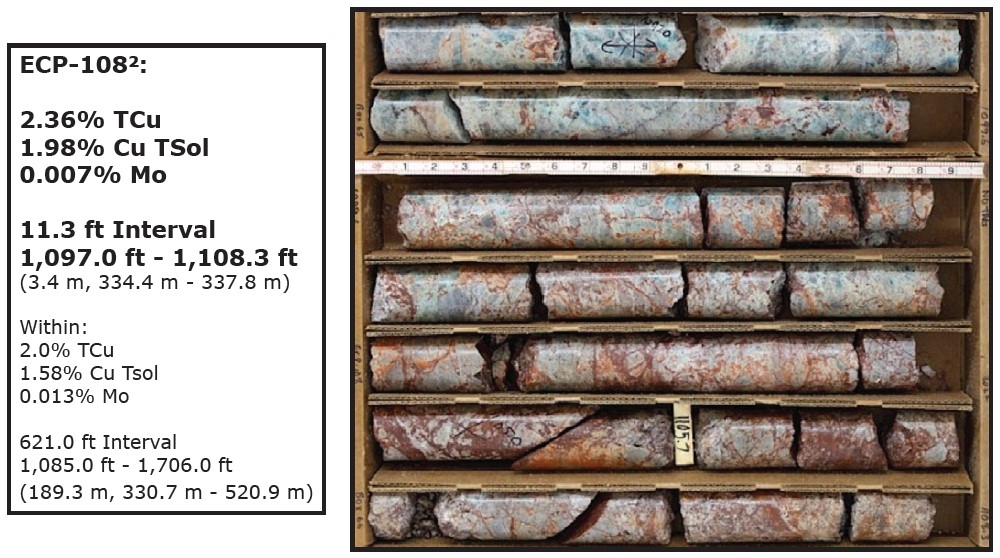

2 https://arizonasonoran.com/news-releases/arizona-sonoran-intersects-621-ft-of-2.0-total-copper-at-parks-salyer-infill-drilling-within-872.5-ft-of-1.64-cut-of-continuous/ (True widths are not known)

Click to Enlarge

Click to Enlarge

Click to Enlarge

Click to Enlarge

Click to Enlarge

Click to Enlarge